Comprehensive Guide to Exness Trading Instruments

Exness is a popular online trading platform known for its extensive range of trading instruments and user-friendly interface. Traders worldwide choose Exness for its competitive spreads, diverse asset classes, and innovative trading solutions. In this article, we’ll delve into the various Exness trading instruments, providing insights into each category and tips on how to maximize your trading potential. For those interested in a deeper understanding of Exness, you can find additional resources Exness trading instruments https://yfauk.org/youngfellow/unduh-exness-mt4-untuk-indonesia-3/.

1. Forex Trading

Forex trading is at the core of Exness’s offerings, with the platform providing access to major, minor, and exotic currency pairs. This vast array of forex pairs allows traders to capitalize on fluctuations in currency values owing to economic events, geopolitical tensions, and market sentiment. Exness offers tight spreads, high leverage options, and a seamless trading experience on popular trading platforms like MetaTrader 4 and MetaTrader 5.

Major Currency Pairs

Major currency pairs include widely traded currencies such as EUR/USD, GBP/USD, and USD/JPY. These pairs typically offer lower spreads and higher liquidity, making them ideal for both beginners and experienced traders.

Minor and Exotic Currency Pairs

Minor pairs, such as AUD/NZD or EUR/GBP, and exotic pairs, like USD/TRY or AUD/SGD, provide traders with opportunities for higher volatility and profit potential. However, they often come with wider spreads and lower liquidity, so caution is advised.

2. Commodity Trading

Commodities are physical goods that traders can buy and sell on global markets. Exness provides trading instruments in various commodities, including precious metals, energy products, and agricultural goods. Traders can hedge against inflation or economic uncertainties through commodity trading, and Exness ensures access to real-time market data and competitive pricing.

Precious Metals

Gold and silver are the most commonly traded precious metals, viewed as safe-haven assets in times of economic instability. Traders can benefit from the inverse relationship between precious metal prices and broader stock market trends.

Energy Products

Crude oil and natural gas are significant energy products traded on Exness. With energy prices influenced by global supply and demand dynamics, geopolitical developments, and seasonal trends, trading energy commodities can lead to substantial profits.

3. Cryptocurrency Trading

The rise of cryptocurrencies has ushered in a new era of trading opportunities. Exness offers a selection of popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. This asset class is known for its volatility, providing traders with the potential for rapid gains, but it also comes with higher risks.

Understanding Cryptocurrency Volatility

Cryptocurrency values can fluctuate dramatically within short periods. Traders should employ proper risk management strategies and stay informed about market news, regulatory changes, and developments in the crypto space.

4. Indices Trading

Indices represent a collection of stocks from various companies, and trading indices allows investors to speculate on the overall performance of specific sectors or economies. Exness provides access to major stock indices such as the S&P 500, NASDAQ, and FTSE 100. These instruments reflect the health of the broader market, making them a suitable choice for traders looking to diversify their portfolios.

Diversification Through Indices

Index trading offers diversification benefits since it encompasses multiple stocks. Traders can gain exposure to market movements without needing to analyze individual stocks’ performance.

5. ETFs and Stocks Trading

With Exness, traders can also venture into ETF (Exchange-Traded Fund) and individual stock trading. ETFs allow traders to invest in a basket of securities, providing a simple way to gain exposure to a market segment or industry.

Choosing Between Stocks and ETFs

While individual stocks offer the potential for high returns, they also come with increased risk due to company-specific factors. On the other hand, ETFs can reduce risk through diversification, making them an attractive choice for more conservative traders.

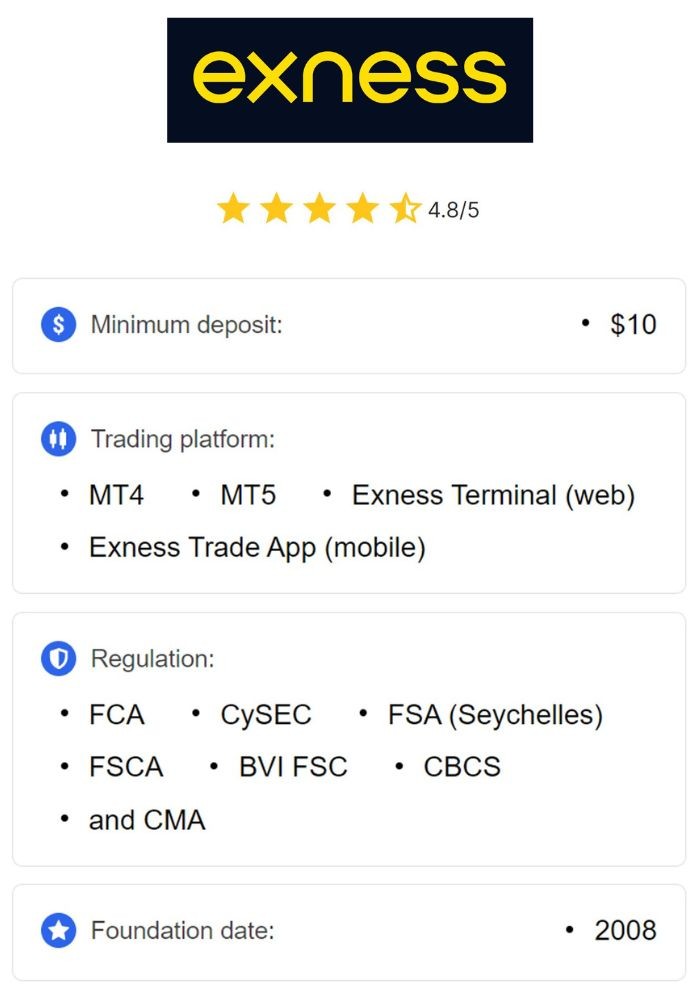

6. Online Trading Platforms

Exness provides users with access to industry-leading trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are designed to meet the needs of a wide range of traders, offering powerful technical analysis tools, customizable interfaces, and automated trading options. Understanding how to navigate these platforms effectively is crucial for executing successful trades.

Advantages of Using MT4 and MT5

MT4 is renowned for its user-friendly interface and extensive library of indicators and tools for technical analysis. MT5 builds upon this foundation by offering advanced features, including additional timeframes and improved analytical tools.

7. Conclusion

Exness offers an extensive range of trading instruments suitable for various trading strategies and risk appetites. Whether you’re interested in forex, commodities, cryptocurrencies, indices, or individual stocks, Exness has the tools and resources to help you succeed. Remember to conduct thorough research, use effective risk management strategies, and choose the instruments that align with your trading goals. Happy trading!